The Blaze Credit Card is an unsecured credit card specifically designed for people who are struggling to raise their credit score. After six current monthly payments, cardholders are eligible for a credit limit increase but pay annual fees and authorized usage fees. If you don’t have or don’t have a credit history and don’t want a secure credit card, Blaze Mastercard might be a good option.

The Blaze Credit Card is an unsecured credit card from First Savings Bank. If you wish to apply for a Blaze Card, you can do so online. However, make sure you have a good internet connection in your area where you will be ordering the same. Let’sLet’s discuss the Blaze credit card application steps in detail:

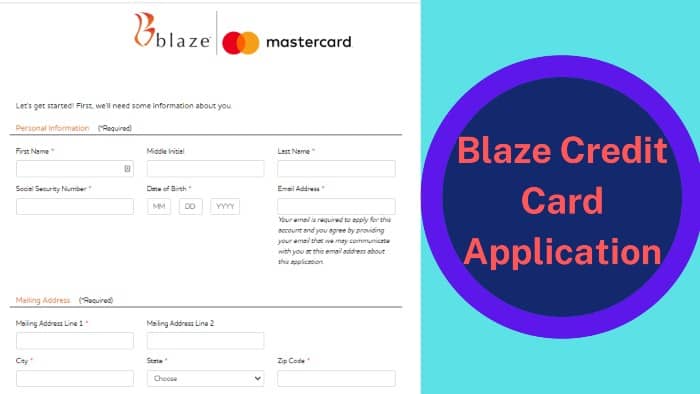

Application Procedure For Blaze Credit Card

Follow these steps to apply for the Blaze Credit Card.

- Please, go to the Application Portal at blazecc.com/Invite/Application/ApplicationForm.

- Then enter the following personal information; First name, middle initial, last name, CPF, date of birth, and email address.

- The following email information is required; Line 1 mailing address, Line 2 mailing address, city, state, and zip code.

- Fill in the following additional information; Home phone, office phone, and mother’s maiden name.

- Enter the following financial information; Gross annual taxable income, non-taxable annual income, rent or property, monthly rent, or mortgage.

- Then follow the onscreen instructions.

Accept Your Mail Offer For Blaze Credit Card Application

- Go to the official Blaze Credit Card website.

- Click on “Accept offer” to receive the offer by email.”

- Enter your reservation number and access code on your acceptance form and click ”Continue”.

- Make sure your email details are correct.

- Enter the following details as prompted on the acceptance form and check the box to continue with the remaining steps.

- Accept the offer online, and you can apply for the Blaze credit card or Blaze Mastercard.